There and Back Again: A Look at Canadian Inflation

August 2023

CANADIAN INFLATION: THE DEVIL IS IN THE DETAILS

While inflation has come off its all-time highs in 2022, its impacts are still reverberating through the Canadian economy (particularly when it comes to the cost of living). Headline inflation, which came in at 3.3% YoY in July 2023, is improving but only in select areas.

The Bank of Canada believes progress has been made, but the struggle is not over yet – their preferred measures (CPI-trim and CPI-median) continue to move downwards at near glacial speeds. The BoC Governing Council expects inflation to remain around 3% for the remainder of 2023, and to return to the 2% target by the end of 2024 – which could have some wide-reaching implications on consumers and businesses alike.

KEY TAKEAWAYS THIS MONTH:

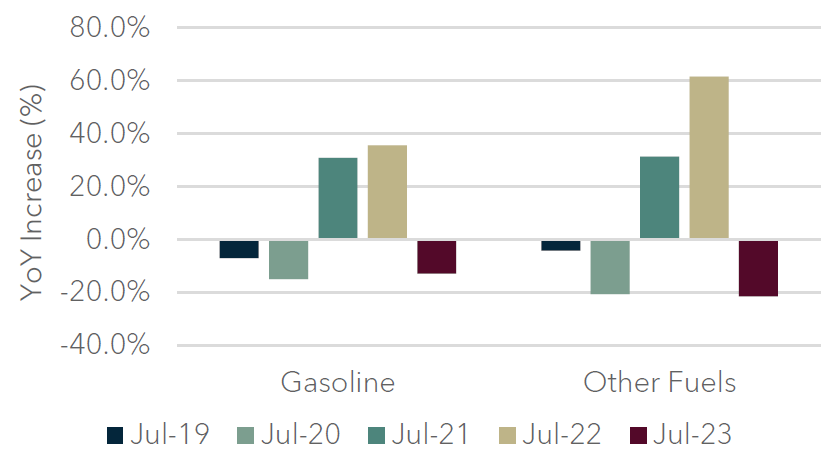

Energy prices to the rescue: Energy prices, primarily driven by gasoline (-13% YoY), continue to drive down inflation. If you were to exclude energy, July CPI would have come in at 4.2% vs 3.3%. Despite the good news, energy prices are still 32% higher than they were pre-COVID.

No relief at home or the grocery store: Price stubbornness in food (+8% YoY) and shelter (+5% YoY) continue to keep inflation elevated. Mortgage interest costs (+31% YoY) continue to rise and match the real estate trends present in many regional Canadian markets.

Consumer spending is still high: A lot of attention is focused on reducing consumer spending, which remains elevated, but the composition of that spending is important to look at. Due to persistent inflation Canadians are spending more on necessities (food/shelter). It does however appear Canadians are addicted to eating at restaurants and continue to spend in that area.

THE BACKUP DATA

HEADLINE INFLATION DOWN OVERALL, OTHER MEASURES NOT AS MUCH.

The highly-monitored headline inflation slightly up ticked in July 2023 (3.3% YoY vs. 2.8% in June 2023) but is generally moving in the right direction. CPI-trim (3.6% YoY vs. 3.7% in June 2023) and CPI-median (3.7% YoY vs. 3.7% in June 2023), which are the preferred measures for the Bank of Canada, have a much slower rate of progress. The Bank of Canada has expressed this is concerning and reflects the true ‘stickiness’ of price levels in the economy and expect inflation will remain at 3% for the remainder of 2023 before gradually declining to the 2% target in 2024.

Canadian Inflation, Monthly (Jan 2020 - Jul 2023)

CPI Highlight: Gasoline, Other Fuels

CPI Highlight: Food, Shelter Costs

CPI COMPONENTS TELL A DIFFERENT STORY.

While inflation has cooled, certain component continue to remain persistently stubborn. Gasoline (-13% YoY) was a major contributor to the downward movement in inflation – however, it is worth noting, in general, energy had a favourable comparison to high pricing in 2022 which may make CPI a little misleading. If this component was removed, inflation would have registered at 4.2% in July 2023. Food (+8% YoY) and shelter costs (+5% YoY) continue to remain elevated, particularly driven by grocery store purchases (+8.5% YoY) and mortgage interest costs (+31% YoY). As the 2022 inflationary basis begins to move out of the BoC’s purview, it will be interesting to see if inflation continues to decline or if it will remain persistent.

CPI Components: Goods vs. Service

CPI Highlight: Mortgage Interest Costs

In terms of shelter costs, there doesn’t appear to be much relief for Canadians. Rented accommodation inflation has increase 5.4% YoY while owned accommodation inflation is accelerating and currently stands at 6%. The main contributor to household ownerships costs is the enormous cost burden associated with holding a mortgage – mortgage interest costs skyrocketed 31% YoY, which matches the BoC’s pattern of aggressive interest rate hikes in 2022/2023. Another interesting component that has increased is homeowners' home and mortgage insurance (+9.5% YoY), which has remained quite elevated post-COVID. Most of these service-based products continue to exhibit price stickiness and the BoC expects this continue for the foreseeable future.

Canadian Consumer Spending, Quarterly (Q1 2018 - Q1 2023)

CONSUMER SPENDING HAS CHANGED.

Canadian consumer spending continues to grow and remain robust, increasing by 9% YoY. Housing and food costs continue to increase substantially (accounting for ~36% of total spending vs. 34.5% pre-COVID), reflecting that Canadians are spending more on necessities. In fact, Canadians are spending $15.5 billion more on these areas, mostly driven by increases in rent, food prices and increased spending at restaurants. It appears that the BoC’s rate hikes haven’t quite had their intended impact on consumer spending, however the Q2 2023 GDP and consumer spending figures (scheduled to come out soon) will provide a more holistic picture of the situation. We will continue to monitor these trends.

Sources: Statistics Canada, Bank of Canada, Diamond Willow Advisory.