A Few of Our Favourite Ramblings

December 2020

REVISITING OUR FAVOURITE DEBT DIGEST TOPICS FROM 2020

As we enter a time of self reflection and anticipation of the fresh start that comes with a New Year (come on 2021, we are counting on you), we wanted to take a moment and revisit some of our favorite ramblings published via the DWA Debt Digest. While we claim to love all of our research topics “equally,” the reality is that some are more forgettable than others. Case in point, our inaugural Debt Digest was a call on how Calgary had reached peak negativity… probably don’t need to revisit that one as our crystal ball was clearly broken.

Not only are we going to have a look at some of our previous topics, we provide an updated outlook or new relevant data points. Ultimately, the point of the Debt Digest is to help our readers stay at the forefront of what we see as key areas lenders and small- to medium-sized business service providers should be paying attention to.

THE SHORT LIST

Without further delay, here are the topics we revisit in this year end edition of the DWA Debt Digest:

Canadian Consumer Interest Rate Sensitivity

Q2/2020 Energy Price War

Data Analytics – big winner in post pandemic world

ESG – Positioned to impact the private debt space

Security values and hard asset lending

Small business lending in Canada

A QUICK THANKS

We can all agree that 2020 hasn’t unfolded like any of us expected but we are proud to see how those in our network showed amazing levels of resilience as everyone navigated the unknowns. We are lucky enough to have a great network of those we can work with, lean on for advice or simply meet for some zoom drinks.

Happy Holidays to everyone and see you on the other side!

JANUARY - CANADIAN’S SENSITIVITY TO INTEREST RATES

ORIGINAL THESIS: Fixed cost inflation (food, shelter, etc.) combined with increased debt service costs is materially outpacing income growth. In a rising interest rate environment, this puts a lot of individuals and businesses in a difficult position. The majority (90%) of consumer bankruptcies are renters as homeowners have been utilizing home equity lines of credit to make ends meet thanks to a hot housing market.

UPDATED VIEW: Interest rate sensitivity is less of a concern for two reasons, i) savings rates amongst Canadians has dramatically increased in the pandemic, and ii) the interest rate outlook is relatively muted for the short to medium term given economic headwinds. Debt to income levels remain very high ($1.71 of debt owed for every $1 earned) but this is largely due to debt associated with home ownership which is buoyed by a strong housing market.

% of Household Disposable Income Required to Debt Service

MARCH - A LOOK AT THE ENERGY PRICE WAR

ORIGINAL THESIS: The energy price war was yet another headwind for the battle-hardened sector. While we had confidence the sector would get through to the other side, we were more cautious about the willingness of investors to continue to support the sector where the risk/return profile had not aligned for quite some time.

UPDATED VIEW: Having made it through the depths of the energy price war (remember negative oil prices?), demand has pushed back towards 94mmbbls/d but is not expected to reach pre-pandemic levels for the near future. Production has responded and provides a more constructive outlook, with OPEC remaining in the driver’s seat on the overall supply/ demand dynamics. Investors continue to push for a healthier sector with greater free cash flow which has driven increased consolidation activity. For a more in-depth view of the Canadian Energy sector, check out the replay of our first DWA Expert Speaker Series.

Global Crude Oil Supply / Demand Balance

APRIL - DATA ANALYTICS BIG WINNER IN POST PANDEMIC WORLD

ORIGINAL THESIS: Our view that big data and data analytics were going to come out on top in the post-pandemic world wasn’t a stretch by any means. Clearly the pandemic has had a massive effect on the underlying trend of moving to more online and this caters to the world of data collection and analytics.

UPDATED VIEW: No real change in view here - if anything we are more entrenched in our view around the value of data analytics. It seems we are set to hear more about deep learning/machine learning that will provide assistance with the predictive side of business decision making. Perhaps we are simply paying more attention now but it seems like data analytics departments are popping up in more and more businesses focussed on putting money to work (Private Equity, Private Debt, Hedge funds, etc.).

Top 5 Uses of Worldwide Artificial Intelligence Spending ($50 billion/year)

JUNE - ESG PRIMED TO MAKE A BIG IMPACT IN PRIVATE DEBT

ORIGINAL THESIS: It is only a matter of time before private companies looking to access debt capital will have to display a track record of ESG initiatives and guidelines. We see this driven by lenders including it in their mandates ultimately meaning businesses (borrowers) will have to react accordingly.

UPDATED VIEW: We are seeing more and more instances of private debt lenders referencing ESG in their mandates and lending practices. This remains a very fractured topic but we suspect to see more formalised measures in the medium term. Our understanding is that raising money for an ESG fund is much easier than deploying that capital. ESG is here to stay, the sooner private companies establish a track record of ESG initiatives, the better from both a business perspective as well as a capital access one.

Then vs Now - The View that ESG Initiatives Improve Long Term Value

SEPTEMBER - A LOOK AT TRENDS IN HARD ASSET SECURITY

ORIGINAL THESIS: Our original thesis that lenders were going to be more conservative when it came to lending against hard assets has played out to some degree but we have to admit this is still very much a developing theme. We mused that lenders were going to reduce their risk profile on when lending against hard assets by providing reduced Loan to Value (LTV’s) ratios.

UPDATED VIEW: This remains a can of worms, particularly in Western Canada where the market is devoid of recent transaction metrics, especially when it comes to certain commercial real estate. Lenders are being more conservative, despite hard asset auction prices appearing to hold steady as lenders remain nervous on the business outlook into 2021. We are planning to keep our finger on the pulse of this one.

Cumulative Goods Sold at Canadian Prairie Auctions - 2020 vs 2019

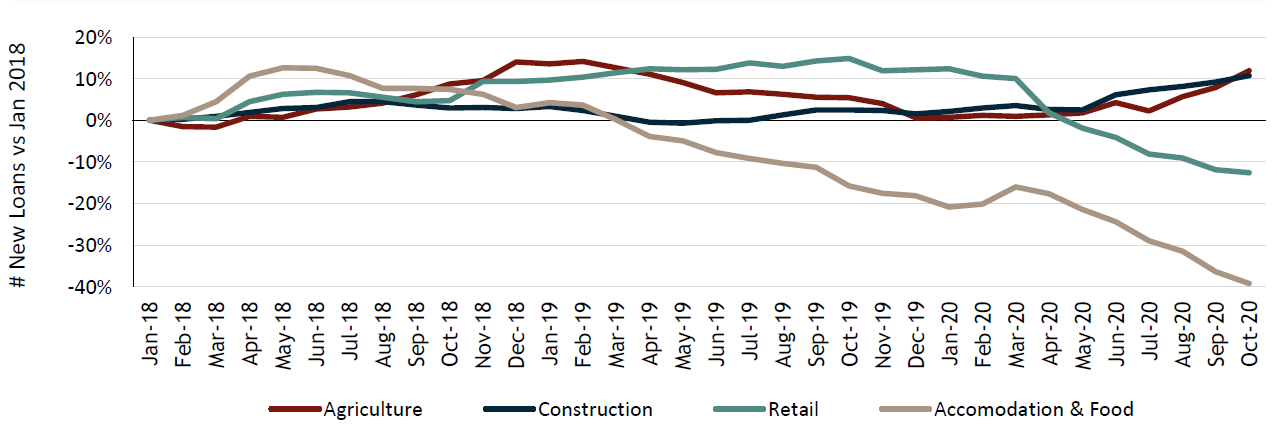

OCTOBER - SMALL BUSINESS LENDING IN CANADA

ORIGINAL THESIS: Despite a somewhat negative stigma towards debt, we argue that access to debt in the right form and amount can make or break a business. Depending on the stage of the business, debt tends to be the least expensive form of capital and is the most sought-after when it comes to small business financing. When access to debt dries up as it has for certain sectors, it quickly becomes a major problem.

UPDATED VIEW: Directionally, nothing has really changed regarding this topic over the past two months as additional lockdown measures are weighing on the sectors already facing stiff headwinds. Overall, the Canadian lending index suggests commercial credit is starting to flow more freely again, but again it remains very sector-specific (and likely lender specific) at this stage in the game.

New Commercial Loans vs January 2018 - By Sector

Sources: Statistics Canada, EIA, Government of Canada, Diamond Willow Advisory, McKinsey & Company, Richie Brothers, Paynet.