An Update on Canadian Debt Markets

December 2023

ACCESSING CAPITAL IS BECOMING MORE CHALLENGING; BORROWERS NEED TO LEARN ABOUT THEIR OPTIONS

Rapidly rising interest rates have had the desired effect of lowering capital availability. In fact, net new debt issuance is down 59% year-over-year while the Banks’ loan loss provisions are up 76%.

Despite this, the Banks continue to dominate the Canadian lending landscape, holding 61% of the Canadian loan book. Meanwhile, the Private Credit market is making major gains and now controls 28% of the market. While obtaining credit from the Banks is becoming increasingly difficult, we see the Private Credit market as finally having its day in the sun.

KEY TAKEAWAYS THIS MONTH:

Slowing Conventional Lending: Commercial Bank loan books are flatlining after a few strong years of growth. In fact, total debt issuance in Canada will be at, or near, six-year lows in 2023. The Banks are also preparing for future weakness with loan loss provisions up 76% year-over-year.

Canadian Private Markets, Primed And Ready To Go: Globally, Private Credit funds have grown 74% in five years and now total $1.5 trillion, with $434 billion of dry powder currently available and ready to be deployed.

The DWA Promise: At DWA, our aim is to quickly evaluate borrower needs and provide a practical capital financing solution that can be achieved through our network of ~450 lenders operating in Canada.

DWA’s Canadian Lender Network

THE CANADIAN LOAN BOOK: WHO’S LENDING?

Canadian Net Debt Issuance (2018 - Sept 2023)

Net new debt issuance is down 59% Y-o-Y

Net Debt Issuance Continues Downward Spiral: Net debt issuance is down 59% Y-o-Y and the trend is continuing in September, which was down 15% from August. This trend is linked with conservatism from large Canadian financial institutions, uncertain economic conditions, higher interest rates, inflationary pressures and a more stringent regulatory environment.

Canadian Credit Loan Composition (Sept 2023)

Banks dominate Canadian lending but are pulling back

Banks Dominate But Have Less Appetite: The big Banks continue to dominate the Canadian lending landscape, accounting for over 60% of the loan book – however, there has been a noticeable decelerating trend in their lending practices. Loan growth has declined to 4.3% in September 2023 on a Y-o-Y basis, compared with a 6.5% average in 2023 and over 10% in 2022.

The Big 6 Canadian Banks: Loan Book Composition

Residential mortgages dominate the Canadian Banks’ loan books.

Mortgages Dominate At The Big 6: Do you ever wonder why the news is full of articles talking about mortgage rates? It is because 47% of the Banks’ loan books are mortgages and if there are ever material defaults, we are all in trouble. The Banks have been diversifying their exposure into commercial loan products, which now account for 36% of all lending.

Commercial Loans Outstanding, Quarterly (Q1/2021 - Q4/2023)

Commercial loan growth slowed materially in 2023 and could turn negative in 2024

Commercial Loan Underwriting Slows: Quarter-over-quarter commercial loans outstanding grew at a rate of 1.5% in Q4/2023, which was a welcome ‘come-back’ for the Canadian Big 6 who experienced a decline last quarter. Annual commercial loan growth has substantially declined on a Y-o-Y basis; 2023 only saw the Big 6’s commercial loan book grow by 4% Y-o-Y, versus 23% in 2022, but matched the 3.8% average growth rates experienced in 2021 and 2020.

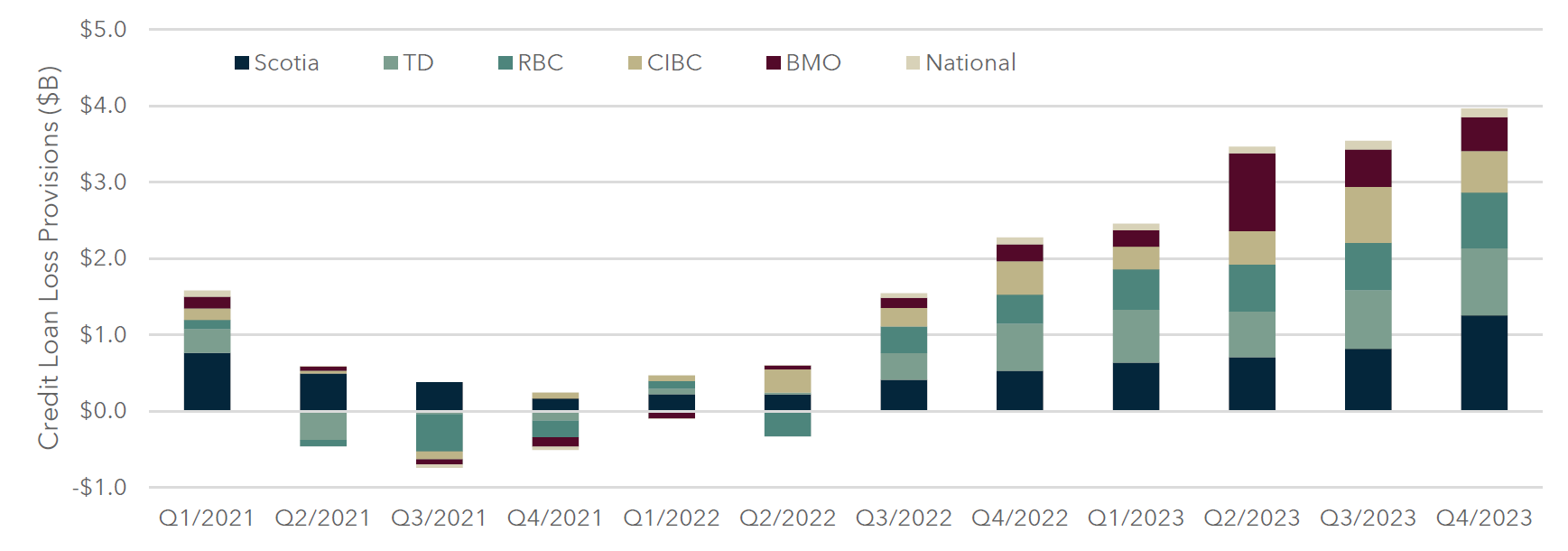

Credit Loan Loss Provisions, Quarterly (Q1/2021 – Q4/2023)

Loan loss provisions are up 74% Y-o-Y, proving the Banks are prepping for economic weakness.

Loan Loss Provisions Up, But Decelerating: The Canadian Big 6 continue to set aside larger provisions for bad loans – up to $4 billion in Q4/2023 (+12% Q-o-Q, +74% Y-o-Y). While this level is not unprecedented, it may signal the Big 6’s decreasing risk appetite for new loan growth. Overall, credit loan loss provisions continue to account for 0.2% of the national loan book, which is in line with the historical pre-COVID level.

PRIVATE CREDIT MARKETS: SHOW ME THE MONEY!

Private Credit: Total AUM & Dry Powder Remaining

Private Credit is flush with cash and ready to lend.

Private Debt Markets Are Primed And Ready To Go: In 15 years, the global Private Credit market has grown by over 5x and now equates to $1.5 trillion.

In Canada alone, DWA tracks over 350 private lenders and has them categorized by lending type, security requirements, rate, and size. Our team has never found there to be a lack of private appetite for deals, which is no surprise given the over $430 billion of dry powder available globally.

KEY CAPITAL CHALLENGES FOR CANADIAN BUSINESS OWNERS

Canadian SMBs: Why Look For Debt? (2013-2022)

Managing working capital remains business owners' main capital challenge.

Managing Working Capital Remains a Key Challenge: Canadian businesses are most in need of working capital and equipment financing which is no surprise given DWA tracks 140 private lenders who offer working capital and equipment financing solutions.

At DWA, we ultimately believe that all businesses should have access to the capital they require to be successful – our lender network has the ability and the technical know-how to become a financial partner to all Canadian businesses seeking a flexible capital solution. They are primed and ready to go – are you?

Sources: Banks, Earnings Reports, Statistics Canada, PitchBook, Diamond Willow Advisory.