The Stars are Aligned

February 2021

IN THIS ISSUE:

We argue a combination of financial and non-financial factors are aligning buyers and sellers in the Canadian mid-market space which sets up a very constructive outlook for M&A activity in 2021.

Buyers, particularly Private Equity companies have a plethora of capital, access to inexpensive debt, and have an improved ability to cycle capital out of old transactions thanks to favourable public markets.

Business owners looking to sell are welcoming high valuations (sector-specific), creative deal structures and possibly having buyers solve non-financial demands like cyber security, ESG and data analytics.

SET-UP INDICATES 2021 LIKELY TO BE A BIG YEAR FOR MID-MARKET M&A

The call for an active 2021 relating to Mid-market M&A is largely the consensus view, and for good reason. The often referenced data points of dry powder (a topic we dug into last month), inexpensive debt, and relatively robust valuation multiples are very supportive and lead to a constructive setup on their own. We wanted to take the conversation a step further and point to some non-financial factors that are likely in the driver’s seat when it comes to the decision to sell.

Financial Factors Supporting a Constructive Mid-Market M&A Set up:

Record amounts of “Dry Powder” or private capital waiting to be deployed;

Historically low interest rates and improving lending sentiment from Canada’s banks;

Competitive deal space is driving higher valuation multiples;

Public market much more willing to support liquidity events via IPO;

Underlying inflation risk may force some to act sooner than later.

Non–financial factors Supporting a Constructive Mid-Market M&A Set up:

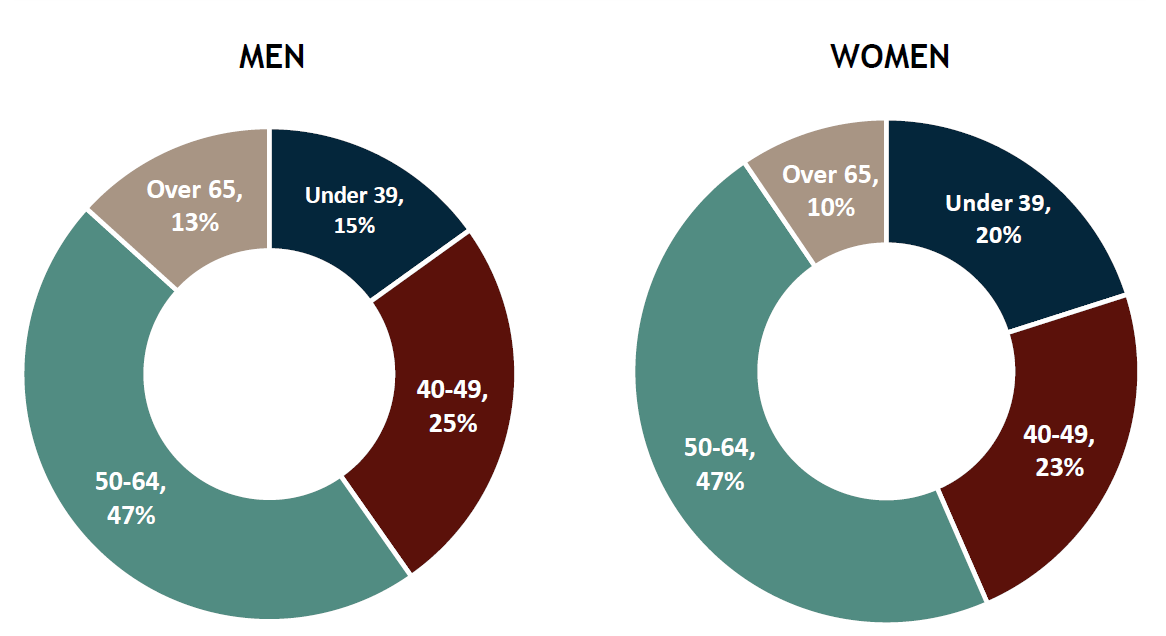

Increasing age of key decision makers in small/medium enterprises;

Amplified need to incorporate cyber security, e-commerce and data analytics into businesses to remain competitive;

Pandemic fatigue from key decision makers;

Increased deal structure creativity to bridge any value gaps.

Age Range of Canadian Business Owners - 60% over 50 Years Old

FINANCIAL FACTORS DRIVING STRONG MID-MARKET M&A OUTLOOK

The financial setup for Canadian mid-market M&A activity is as constructive as it has been for a long time. The main drivers of this include:

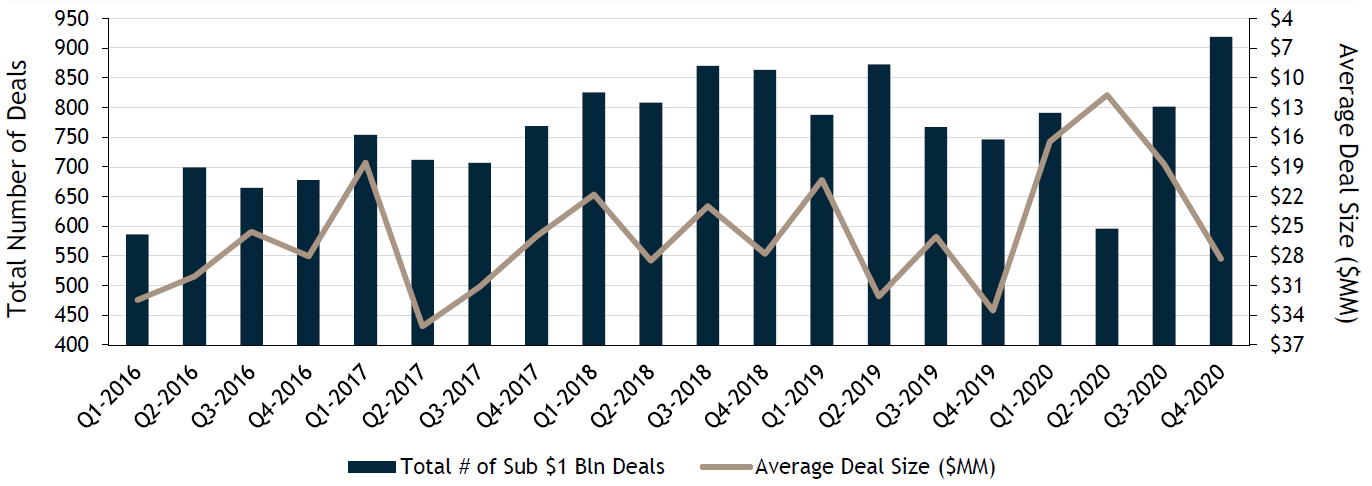

1. BACKLOG OF SIDELINED CAPITAL – A topic we explored in depth in last month’s research report, there is a record amount of dry powder in the Private Equity and Private Debt sectors. While there is always a healthy amount of dry powder, the pandemic threw the historical ratio out of whack, giving urgency to getting capital out the door. The pent-up demand was evident in Q4/2020 and we see no reason this upward trajectory will change in 2021.

Canadian Sub $1 Billion Deals Hit New High

2. LOW INTEREST RATES – this really has a two-fold impact, namely:

Increased amount of capital flowing into the private space as investors are seeking better risk adjusted returns and higher yields through asset classes such as private equity and private debt.

Low borrowing costs make financing acquisitions relatively cheaper driving better returns for the acquirer

3. INCREASED INFLATION EXPECTATIONS - As indicated by the spread between the 2-year and 10-year government bond yield hitting multi-year highs, the market is increasingly convinced in an economic recovery that will drive inflation pressure and ultimately result in rising interest rates. This is constructive for near term acquisition activity as buyers will look to lock in cheaper debt and depending if the business target handles hard assets, purchasers will want to own those assets sooner than later.

Canadian Bond Yield Spread (2yr vs 10yr) Hits 5 Year High

4. FAVOURABLE PUBLIC MARKETS ENABLE THE CYCLING OF CAPITAL:

In a typical quarter, Canada sees between 30- 40 initial public offerings (IPOs). The pandemic had a major impact on that in early 2020 but the number quickly returned to run rate levels.

A supportive public market allows sponsors (Private Equity) to realise a liquidity event and ultimately be in a position to recycle that capital into new opportunities.

We suspect robust IPO activity will continue to be strong in 2021 given current public market valuations remain robust for favourable sectors.

Canadian IPO Activity Bounces Back

NON-FINANCIAL FACTORS DRIVING STRONG MID-MARKET M&A OUTLOOK

Despite financial factors typically grabbing the headlines as motivators behind M&A, there are plenty of non-financial drivers we see playing a major role in the decision making process:

New World Requirements – We are admittedly painting with some broad strokes here, but we look at the need to have an effective e-commerce set up, a defensive cyber-security system and the increased need to have data analytics initiatives in place requirements in order for businesses to remain competitive. On top of this, we can tack on ESG initiatives and small/medium business owners are having to put serious thought to issues that likely didn’t cross their radar a handful of years ago. This new task list is likely too onerous for many long time business owners and selling to another party offering solutions to these new demands is a good way secure the future of the business.

Pandemic Fatigue – The pandemic has injected a high degree of uncertainty into many business segments, while also incorporating further stresses relating to COVID protocols and employee health. Couple this with the fact that 60% of Canadian business owners are over the age of 50 and we see an increased willingness for owners to consider selling.

Increased Deal Structure Creativity – In times of heightened uncertainty, having earn-outs, Vendor Take Backs (VTB) and working capital adjustments offer great ways to bridge any valuation gaps, align buyers and sellers, and ultimately get more deals done.

FINAL THOUGHTS

We ultimately see 2021 Canadian mid-market acquisition deal activity carrying the momentum that was seen in the second half of 2020. Alignment of buyers and sellers is increasingly evident setting up the constructive outlook.

Buyers have an abundance of capital ready to be deployed which is further bolstered by access to inexpensive capital (via cheap debt), inflation risk is bubbling in the background, and the public market is supporting liquidity events allowing sponsors to realise gains and cycle capital.

Sellers of strong businesses in favourable sectors will have a plethora of options on the table, high valuation multiples are being paid, and buyers can add value to businesses through specialised expertise ultimately solving the needs for new demands that will be required to keep businesses competitive (ESG mandates, data analytics, etc.). On top of this, creative deal structures ensure a greater chance of alignment.

Forecasting M&A activity tends to be a bit of a fools errand but given the constructive set up for the mid-market, we are comfortable sticking our necks out on this one.

Sources: Statistics Canada, Diamond Willow Advisory, Crosbie & Co., Capital IQ.