Soft as a Delta Flight Landing: Canadian Insolvencies & Q1 Bank Earnings

February 2025

INSOLVENCIES RISING AS ARE BAD LOAN PROVISIONS

Canadian businesses faced continued macroeconomic pressures in 2024 as corporate insolvencies increased by a staggering 28% YoY. With the global volatility created by President Trump, we expect 2025 to be another robust year for insolvency professionals. Although banks continue to lend, a more worrying trend is gross impaired loans grew by 13% QoQ (+61%YoY) and credit loan losses were up 3.4% QoQ (+28% YoY). This combination of rising insolvencies and escalating impaired loans paints a picture of a more cautious and uncertain economic outlook going forward. Engaging an experienced advisor, such as DWA, can help you navigate this uncertainty and beat the odds!

Key Takeaways this Month:

Insolvency Data Continues To Be Scary: Canadian businesses continued to be challenged in 2024 with corporate insolvencies increasing by 28% YoY. The trend is down from a peak in January, but we expect will remain robust through a volatile 2025.

No Industry Is Safe… Except One: Industries, such as Healthcare (+67% YoY), IT (+44% YoY) and Environmental Services (+41% YoY) were most impacted while, Mining and Oil and Gas Extraction was the only industry to see a YoY decline in insolvencies (-33% YoY).

Canadian Bank Earnings Send Mixed Signals: In Q1 2025, the Canadian Big 6 Banks reported a 2.7% QoQ increase in total commercial loans outstanding but a 13% QoQ increase in gross impaired loans and a 3.4% QoQ increase in credit loan loss provisions. Most concerning is the rise in gross impaired loans as a percentage of total commercial loans, which increased to 1.1% in Q1 2025 – this is a level not seen since COVID and should be cause for concern.

Canadian Corporate Insolvencies

Canadian Corporate Insolvencies increased by 28% in 2024 and global volatility in 2025 could continue this trend.

Canadian Corporate Insolvencies

Corporate bankruptcies increased 29% YoY while corporate bankruptcy proposals have increased by 27% YoY.

Ongoing Challenges In 2024: Canadian businesses continued to struggle in 2024 against a macroeconomic backdrop that included heightened uncertainty and labor market challenges. Going forward, we have a high-level of conviction that continued economic uncertainty (specifically driven by US-Canadian tariffs) will continue to create a challenging environment for Canadian businesses.

Select Industry Highlights: Corporate Insolvencies (2022 - 2024)

Except for Mining and Oil and Gas Extraction, every industry experienced an increase in insolvencies in 2024.

Increased Insolvencies Across Industries: In 2024, substantially all Canadian industries saw a material increase in insolvencies. Some industries were more impacted compared to prior years, including Env. Services and Admin Support (+41% YoY), IT (+44% YoY) and, surprisingly, Healthcare (+67% YoY). Notably, Mining and O&G Extraction was the only industry to see a decline (-33% YoY) in 2024.

Provincial Highlights: YoY % Change in Corporate Insolvencies (2021-2024)

Unsurprisingly given sector trends, corporate insolvencies in BC, AB, and MB/SK grew by 8%, 6%, and 5% respectively, vs. Ontario and Quebec, up 19% and 13% YoY in 2024 respectively.

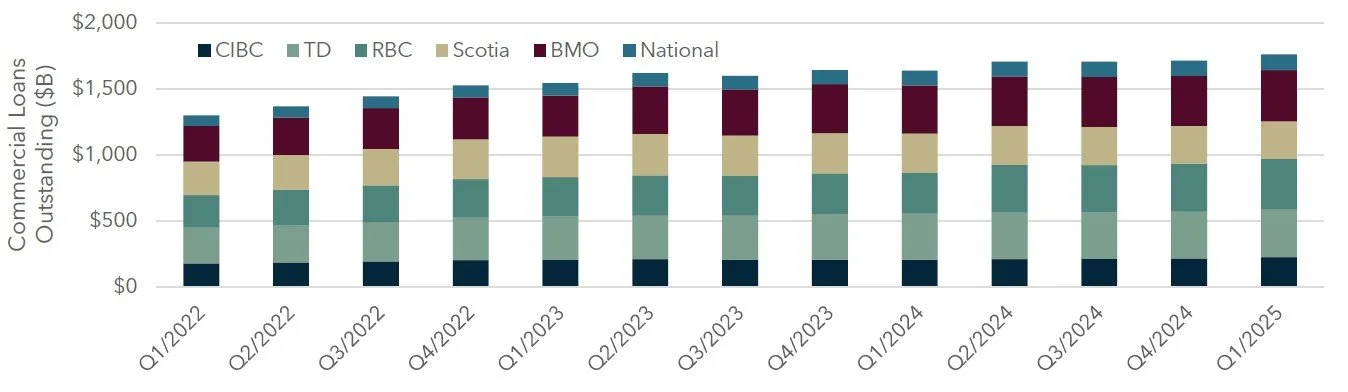

Big 6 Bank Earnings: Total Commercial Loans Outstanding

In aggregate, the Canadian Big 6 Banks reported commercial loan growth of 2.7% QoQ and 7.6% YoY.

Big 6 Bank Earnings: Gross Impaired Loans

Gross impaired loans grew to $20B and now represent 1.1% of total commercial loans outstanding, a level not seen since COVID.

Big 6 Bank Earnings: Credit Loan Loss Provisions

Credit loan losses continue to grow at a slower rate in Q1 2025, up 3.4% QoQ.

Sources: Banks reporting, Equifax, Statistics Canada, Diamond Willow Advisory.