The economic ripple effect of the Coronavirus

February 2020

WHAT’S INSIDE:

As the number of new daily cases of COVID-19 slows, attention is starting to shift to the economic impact a slowdown in the Chinese economy is having on the world.

Outside of the energy sector, Canadian industries most exposed to a slowdown in China include agriculture, forestry and mining.

The energy fears are warranted as the IEA is expecting a Q1’20 decrease in oil demand – the first decrease in 10 years.

IT’S A SMALL, INTERCONNECTED WORLD

Like everyone, our newsfeeds have been dominated with articles on the latest global health scare and while the number of new daily reported cases seems to be falling, the economic ripple effect seems to be accelerating. Headlines have begun to gravitate to the potential economic ramifications and given increased funds flow into safe haven assets like gold, there are plenty of nervous investors out there. Despite 99% of reported cases residing in China (82% contained to the Hubei province) the impacts are being felt closer to home. We see the Government of Canada 5 year bond yield offering the best indication of nervousness with the yield down nearly 15% over the past month, but a recent recovery is showing signs we might be past peak negativity.

COVID-19 Impact on Commodity Prices and Bond Yields

ANOTHER HEADWIND FOR CANADA’S ECONOMY

COVID-19 came at an inopportune time (no, there is never a good time for a worldwide health pandemic) as Canada’s economy came limping out of 2019. Despite a 16% drop in Canadian export value to China in 2019 (vs 2018), China remains Canada’s second largest direct buyer of goods. The slowdown of the Chinese economy, thanks to nearly 10% of the Chinese population being quarantined, will have a direct impact on Canada, particularly the farming (Canola), forestry and energy sectors. A poor GDP showing in Q4’19, COVID-19 headwinds, and the recent rail blockades are putting a Bank of Canada interest rate cut very much in play for H1’20.

Tracking the number of COVID-19 Infections

Over 75,000 people have been diagnosed with the virus, of which, 98.8% reside in China.

Outside of China, 25 countries have listed patients with the virus. Singapore, Japan and Korea have the highest number of cases at 81, 73 and 51 respectively.

Daily Rate of New COVID-19 Cases

Peak rate of new daily cases hit early February and has shown a steady decline with more recent data pointing to ~2,000 new cases a day.

Note: we normalised the increase in new cases on Feb 17th with the new reporting standard

CANADIAN SECTORS MOST EXPOSED TO A CHINESE SLOWDOWN

Hard to pin down the lasting economic impact of the COVID-19 virus at this stage or what stimulus measures the Chinese government may undertake to avoid economic contraction but there are certainly varying degrees of Canadian industry exposure. In 2019, Canada exported nearly $24 billion worth of goods to China. The agriculture and forestry industries carried the most weight with agriculture grains (mainly Canola) making up 13% of that $24 billion with pulp products from the forestry industry coming in just behind at 12%. An indirect impact on Canada would be the ripple effect of a Chinese slowdown on the US economy, our largest export customer by a factor of 5.

Canadian Exports to China by Industry Weight (2018)/b>

AGRICULTURE AND FORESTRY MOST EXPOSED

2019 exports to China totalled nearly $24 Billon, down from $27.7 billion in 2018 as geopolitical tensions impacted trade.

Most exposed to a slowdown in China’s economy would be agriculture, forestry and mining

The top 20 industries exporting goods to China made up 70% of total export value.

Crude Oil (WTI) vs. New COVID-19 Cases

Between initial reporting and the number of new daily cases hitting its peak (Feb 5th), benchmark oil prices lost over $8/ bbl (over 15%). The correlation between new cases reported and oil prices is 0.87 over the past month. Pretty clear correlation.

BoC 5yr Bond Yields vs. New COVID-19 Cases

Canadian Government bond yields dropped materially in the early stages of the virus and have since stabilized. Being the main driver of 5 yr. mortgage rates, we suspect to see posted mortgage rates fall in the coming weeks.

Canadian Canola prices vs. New COVID-19 Cases

Grains and Canola in particular are one of Canada’s largest export products to China so it comes as no surprise that spot Canola prices are showing a negative 0.65 correlation to new cases.

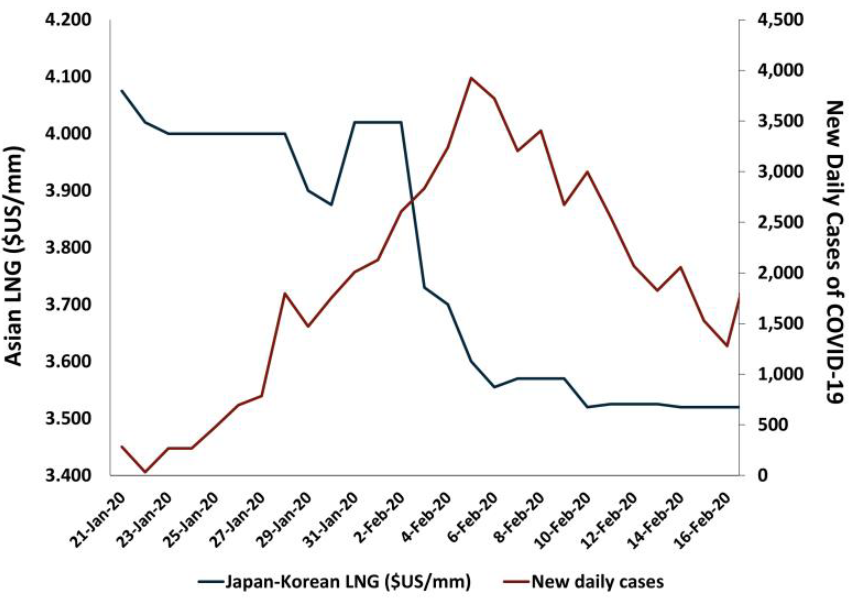

Asian LNG prices Vs. New COVID-19 Cases

SO NOW WE WAIT

From Canadian mortgage rates to oilfield activity in northern Alberta, its clear COVID-19 is having far reaching economic implications. We are by no means brushing off the seriousness of this latest health pandemic but we do take solace in the fact that the number of daily cases seems to be stabilizing and the partial rebound in exposed commodities and indices suggest we are beyond peak nervousness. Having said that, we are anticipating increased microeconomic implications as China plays a pivotal role in the global supply chain, serving as a stark reminder how the shutdown of a city containing less than 1% of the world’s population impacts us all.

Sources: Bloomberg, Government of Canada, Alberta Government, Diamond Willow Advisory, World Health Organization, Statistics Canada.