Prepare for Landing… Could be Soft, Hard, or We Might Crash

June 2022

COMPLICATED TIMES CALL FOR BALANCE SHEET STRENGTH

The phrase ‘unprecedented’ seemed to become viral during COVID, and the trend has persisted into 2022. High inflation, a tight labour force, supply chain challenges, soaring input costs, and now rising interest rates are making it harder and harder for companies to deliver strong earnings. It is no wonder the R-word (recession) is being thrown around regularly. So what should business owners do about it? Keep reading to find out.

Our Thoughts: Business owners and managers should be positioning their companies for extended economic weakness or dare we say, a pending recession. A few strategies include:

Having multiple financial partners with different risk tolerances

Taking steps to strengthen the balance sheet (i.e. pay down debt, sell non-strategic assets, refinance or consolidate higher cost debt)

Diversify your supplier and customer base

Try to move to a variable versus fixed cost structure

Cut expenses.

THE BACKUP DATA

Ongoing Inflation: Persistent inflation (US: 8.5%, CDN: 6.8%) has central bankers fighting two simultaneous battles: managing inflation and monitoring the impact rising interest rates will have on business growth.

US Fed Fund Rate vs. CPI (Monthly)

ENERGY SHOCK

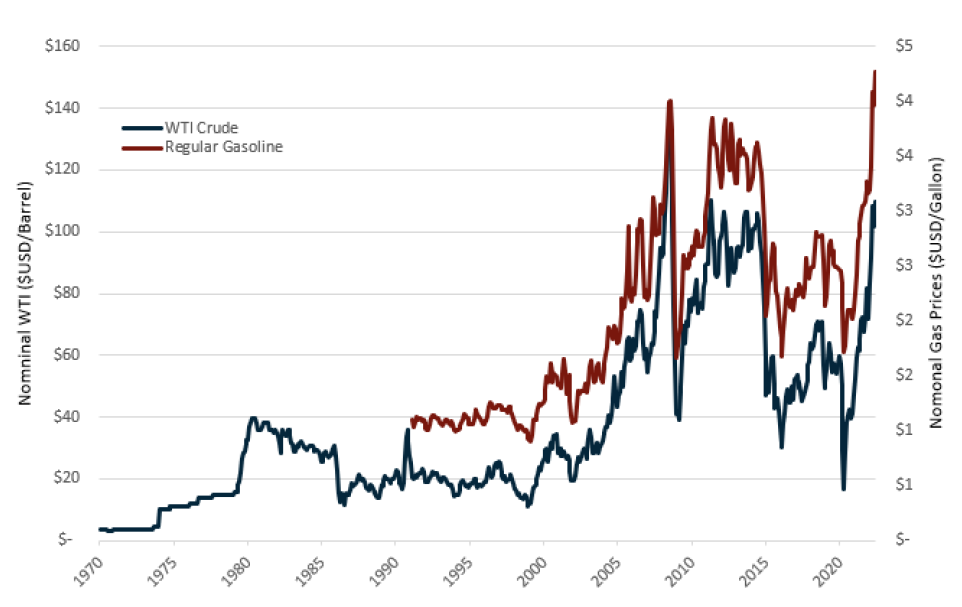

The restrictions on Russian oil, which accounts for 7.3% of the global supply, and a lack of investment over the last few years has had noticeable impacts on energy prices. Higher input costs are the norm and consumers are certainty hurting at the pumps.

Nominal WTI & Gasoline Prices ($USD, Monthly)

BORROWING RATES

Mortgage rates are low on a historical basis but have moved upwards, most notably breaching the 5% threshold in the US for the first time since 2011. The cost to borrow for businesses is also on the rise putting further pressure on cash flow.

30-Year Fixed Mortgage Rates (Average, Monthly)

RECESSION TALK IS COMMON

One of the leading indicators of a recession is the yield spread which recently inverted potentially signalling a recession. There are numerous other indicators, many of which are pointing to the same conclusion.

10-Year/2-Year Treasury Spread (1995-Present)

Sources: EIA, CMHC, Federal Reserve Bank, Bank of Canada, Statistics Canada, Diamond Willow Advisory.