Winners & Losers In a Strong US Dollar Environment

November 2022

A STRONG US DOLLAR IMPACTS CANADIAN BUSINESS, BUT WHO IS MOST IMPACTED?

The US Dollar (USD) has been at the center of many economic stories in 2022, which likely isn’t surprising given its rising star status among global currencies. The surge in the USD has been caused by a mixture of factors, including a market risk-off sentiment and central bankers raising interest rates. These factors, among others, have rewarded the USD which has appreciated 5% and 11% against the Canadian Dollar (CAD) and DXY Index YTD respectively, peaking at 10% and 20% in October.

What does a strong USD mean for Canadian businesses? Generally speaking, a strong USD enhances the profit-profile of export-based businesses, while import-based businesses are negatively impacted. Year to date, exporters are receiving 9% more for their products while imports are paying 11% more for inputs, on average. Who is taking on a brunt of these FOREX gains/losses? Read on to find out.

Our Thoughts: The USD has added another layer of uncertainty to the decision-making process of Canadian business owners and lenders. Export-based industries, such as Energy, have clearly benefitted from a strong USD, while import-based industries, such as Consumer Goods, have taken the brunt of FOREX-related losses. While this might seem like a dream/nightmare scenario, the strong USD trend is unlikely to persist in the long term – in fact, in the last few weeks, we have witnessed the FX rate drop from $1.39 to the current $1.33. This should be a consideration of both lenders and business owners as they begin to forecast and evaluate their plans for fiscal 2023.

THE BACKUP DATA

Historical USD/CAD And DXY Index (CAD, UK, Japan, Euro, Sweden, Switzerland): Following COVID, the USD has gradually been increasing in value against the CAD and, more broadly, its global peers in the DXY Index. October marked only the fourth time in 20 years that the CAD/US FX rate touched $1.40.

Long-Term USD/CAD FOREX Rate and DXY, Sept 2003 - Present

CANADA’S TRADE RATE IS UP, BUT MORESO WITH THE US

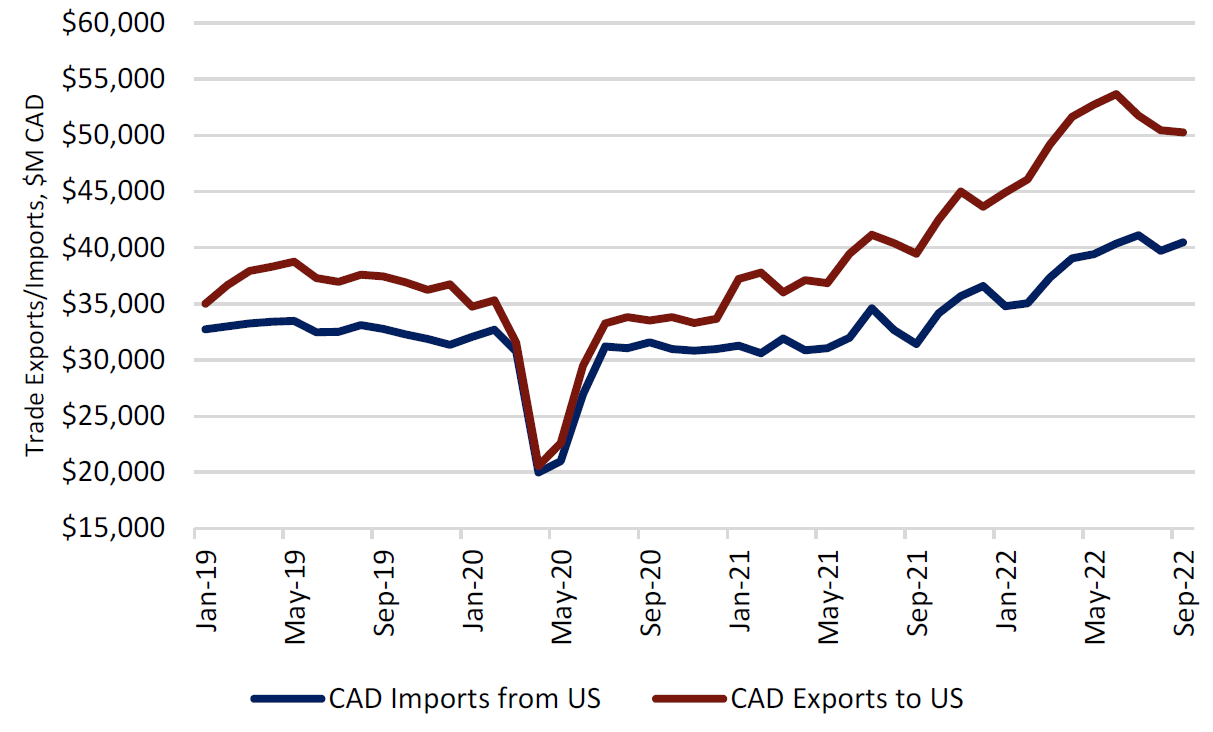

The Canadian Trade Account has fully recovered from the COVID-era and has grown at an astonishing rate of 14% and 19% per annum for imports and exports, respectively. As our most valuable trading partner, the US has played a critical role in this growth. After adjusting for fluctuations in the USD/CAD exchange rate, the annual export growth rate to the US currently stands at 24%, far outstripping the annual import from the US growth rate of 14%. For comparative purposes, Canada’s other trading partners, such as the EU and UK who have export growth rates of 1% per annum and -6% per annum, respectively, and import growth rates of 18% and 7%, respectively. As a result of the persistently high export to the US growth rate, the Canada/US trade surplus has grown to 27% versus its historical average of 14%. This provides a clear signal that the US is enjoying cheaper Canadian goods.

Canadian Trade Account Balance, Jan 2019-Aug 2022

US/Canada Trade Account Balance, Jan 2019-Aug2022

THE NOTABLE WINNERS AND LOSERS OF THE STRONG USD

ENERGY CONTINUES TO BE ON FIRE

Energy products continue to be a core export in the Canadian economy experiencing a 27% price increase YTD 2022. Volumes have increased 13% in the same period.

Other notable winners of the strong USD include Metal Ore producers (48% increase in volume in the 2022YTD period) and Farm-Related Exports (12% price increase and 22% volume increase in the 2022YTD period).

Notable Winner: Energy Products, Jan 2019-Aug2022

CONSUMER GOODS ARE BECOMING MORE EXPENSIVE

Consumer goods, on average, have experienced a 9% increase in import prices in 2022YTD versus 4% historically. Interestingly, this segment has also experienced a 12% increase in volume in 2022YTD, showing that it remains a staple product to Canadians.

Other notable losers of the strong USD include Industrial Equipment/Parts (15% increase in price 2022YTD) Basic/Industrial Chemicals (15% increase in price 2022YTD).

Notable Loser: Consumer Goods, Jan 2019-Aug2022

Sources: Bank of Canada, Bloomberg DXY Index, Company Reports, Diamond Willow Advisory.